REAL ESTATE PRODUCT DESCRIPTION

TIN is an investment program, aimed at the securitization of real estate assets allowing the investor to form part of a select group of owners of equity securities backed by first level real properties.

A TIN investor is entitled to receive income both from monthly rents of the economic exploitation contracts and from the commercial appreciation in value of the real estate portfolio over time.

Download TIN 2025 Presentation

Download TIN Formation Document

Some advantages and benefits for the investor:

Monthly distribution of income

Stable and attractive profitability

Moderate – conservative risk

Independent team of experts of good standing

Solid corporate governance and institutional support

Investment in stabilized real properties.

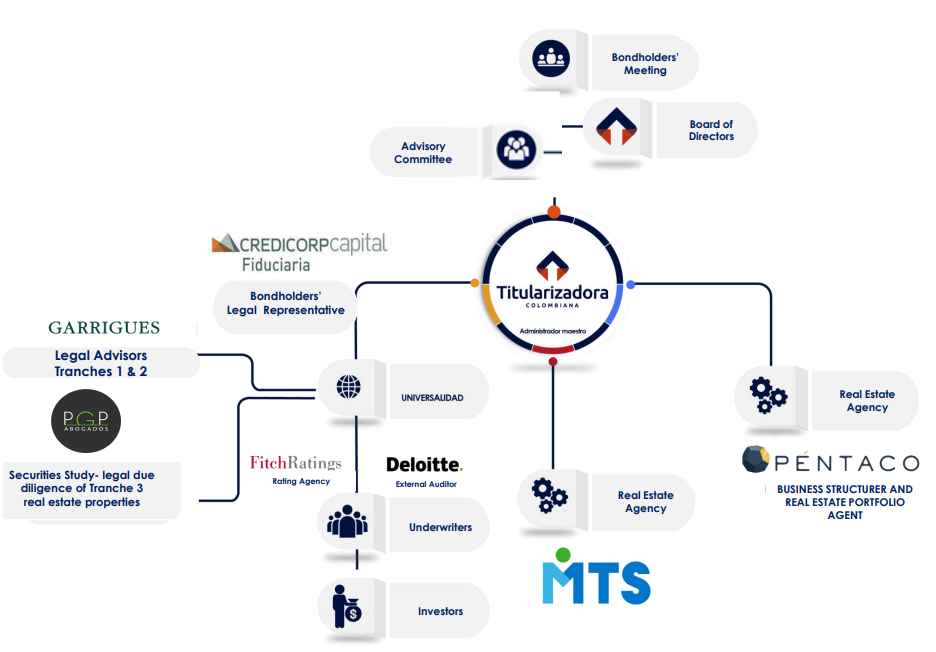

Titularizadora Colombiana as master servicer of the program designed a solid, efficient, and transparent corporate governance structure that provides for the optimal management of the Real Estate Universalidad.

Main Functions

- Approves annual closing of the fiscal year.

- Approves changes to the prospectus and the rules.

- Approves Program of Issue and Tranches.

- Approves changes to the investment policy.

- Approves borrowing and lending operations.

- Approves real estate businesses.

- Approves the strategic investment plan.

- Approves the breakdown of the portfolio.

- Approves Directives on Servicing and

- monitors the profit outcome of the portfolio.

- Recommends real estate businesses.

- Makes recommendations about the product development.

- Determines the underwriting price.

Download Internal Regulations Advisory Committee

Download Resumes of Advisory Committee members

Exercise of the rights and defense of the interests of bondholders.

- May participate in the advisory committee, in a non-voting advisory capacity.

- Sends notice of the meeting for the Bondholders’ Meeting.

- Prepares a half-year report on the program status.

The Universalidad seeks to build a balanced portfolio diversified by location, real estate asset type, economic sector, lessee, low volatility and low risk real estate assets, pursuing the maximization of the bondholders profitability.

The Universalidad seeks to build a portfolio of real estate assets that create income with moderate-conservative volatility and risk. The type of real estate asset, lessee, and location will be variables that will depend on the opportunities and other factors which show up in the market at the time the purchases are completed.

The portfolio of the Universalidad will be diversified by Real Estate Asset type, investment strategy, location, lessee, and economic sector, always in pursuance of a balanced Portfolio to maximize the bondholders’ profitability and to maintain the risk profile.

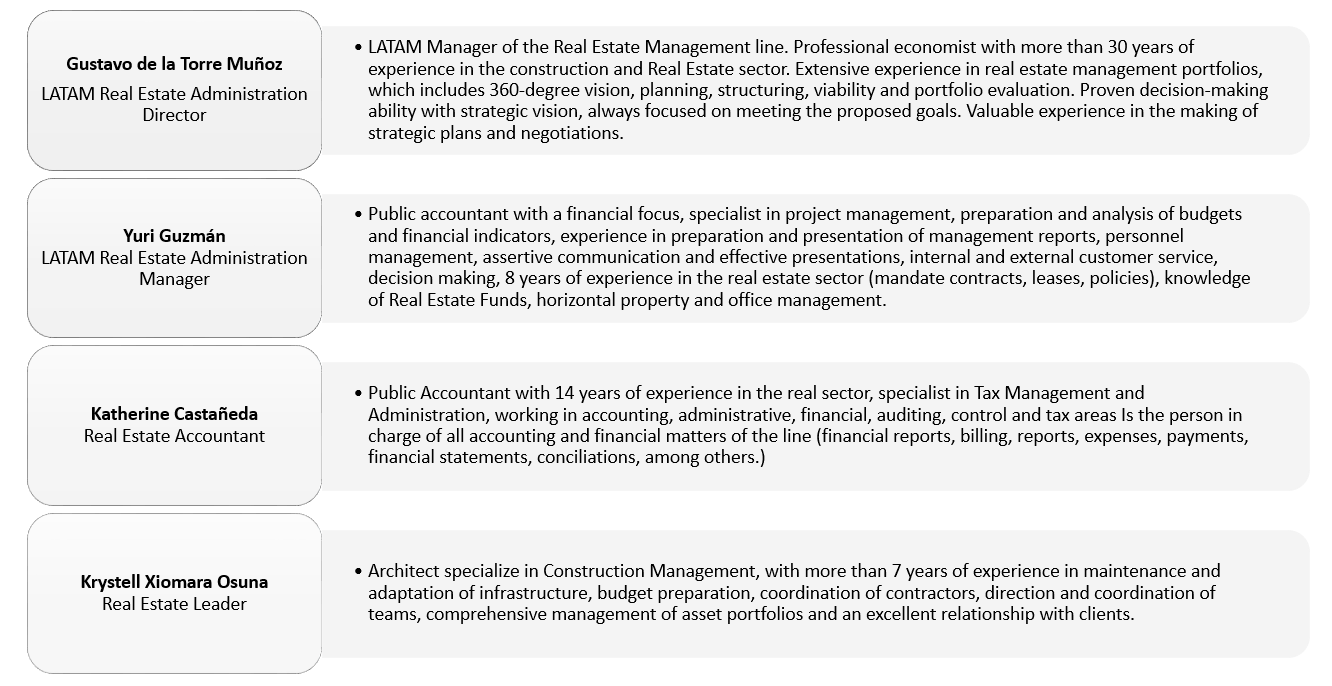

Our Team

The investment program team is comprised of professionals of different disciplines with wide experience in the real estate and financial sectors.

Sixty-nine issues backed by Mortgage Loans, Consumption

Loans with Drafts and Rediscount Loans Portfolios. More

than COP 25 trillion in Mortgage Loans

COP 3.8 trillion of Managed Balance.

Renowned and recurrent issuer and IR Certification.

Structurer, agent and manager of real estate investment vehicle.

Managed real estate transactions over COP 2.6 trillion in the last seven years. Professionals experienced

in the issuance of equity securities for more than COP 1.1 trillion. Professionals with more than twelve

years of experience in integrated management of real estate investment vehicles.

We are the leading company in Integrated Real Estate Services, with a track record of 21 years in charge of the strategic management of more than 6 million square meters, with global coverage, offering the best international practices in real estate services for corporate, logistics, commercial, and multi-purpose assets

PARTICIPANT STRUCTURE: